operating cash flow ratio importance

The ratio takes into consideration a. Pay-out-ratio based on free-cash-flow per share within last 12 months.

Cash Flow Formula How To Calculate Cash Flow With Examples

Current ratio 26 Liquidity ratio or acid test or quick ratio 26.

. Payout-ratio based on free-cash-flow. Learn Basic Accounting Ratio Analysis Tutorial Accounting Interview Questions Debit vs Credit in Accounting Accounting Equation. The operating cash flow formula can be calculated two different ways.

Below is an example calculation of EBIT. The importance of Operating activities. The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share.

It is normally compared to the total capital employed and is calculated by adjusting net. The cash operating cycle concept of working capital for a business is the main indicator of whether the working management strategy of a business is effective. In the simple example above we showed a simple payment hierarchy with CFADS first going to senior debt followed by payments to equity.

Cash flow is an important statement that auditors analysts and other parties use to check the sustainability of the net profit. The first way or the direct method simply subtracts operating expenses from total revenues. Is the money generated daily by a companys business operations.

This cash-flow hierarchy is modeled as a waterfall. None more so than this which highlights the vital importance of cash to modern small businessesWhile profit turnover and even market share are all indicators. Cash Ratio 25000 21000 15000 15000 Cash Ratio 153.

Cash-flow management is vital to the health of your business and it is in the day-to-day management. Importance of SOPs for Accounts Finance Department. Importance of Cash Operating Cycle.

And 3 financing activities. An optimal cash conversion cycle can help the business run its operations smoothly and can also positively impact the profit and earnings of a business. It is determined as the ratio of Generated Profit Amount to the Generated Revenue Amount.

Operating activities include a companys day-to-day activities for example purchasing raw materials or making sales. If cash flow is not showing any jump then most of the sales are made on credit and there is a risk regarding the recovery. Current account and savings account ratio of a bank is the ratio of deposits in current and savings accounts compared to its total deposits.

In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed in. From this CFS we can see that the net cash flow for the 2017 fiscal year was 1522000. Operating cash flow is an important benchmark for an analyst to determine the companys financial stability using its core business activities.

This can be realized either as cash sales or credit sales. In practice required payments for reserve accounts as well as multiple tranches of debt create a more complex hierarchy. Cash inflows result from cash sales and collection of accounts receivable.

The bottom line of the cash flow statement shows the net increase or decrease in cash for the period. Banks do not give any interest on current account deposits and the interest on a savings account is usually very low between 3-4. It indicates whether positive cash flow can be maintained for growth rather than external financing.

Each part reviews the cash flow from one of three types of activities. As cash ratio is 153 which means the company has more cash than they need to pay off current liabilities. There are multiple uses of cash ratio which are as follows-The cash ratio measures the liquidity of the company.

Although long-term profit growth is of utmost importance the. The bulk of the positive cash flow stems from cash earned from operations which is a good sign for investors. The cash flow generated from operating activities is termed operating cash flow.

Capital structure ratios are very important to analyze the financial statements of any company for the following reasons. In case of negative free-cash-flow 100 percent will be shown. This calculation is simple and accurate but does not give investors much information about the company its operations or the sources of cash.

Here lies the importance of net income in the cash flow statement. Compound annual growth rate of the operating cash flow per share within last 10 years in percent. 39860 Earnings 15501 Taxes 500 Interest.

What is the Importance of Operating Income in Business. Generally cash flow statements are divided into three main parts. Same Business Can Yield Different Returns.

Operating Cash Flow. Watch the video below on Everything you want to know about CASA Ratio. Operating Cash Flow OCF.

This is a guide to Cash Flow Statement Examples. To start the computation of cash flow from operating activities you need to start with the net income we will learn how to find out net income in the next section. This is a common method used by analysts to calculate EBIT which can then be used for valuation in the EVEBIT ratio.

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Calculator

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Definition Formula Example

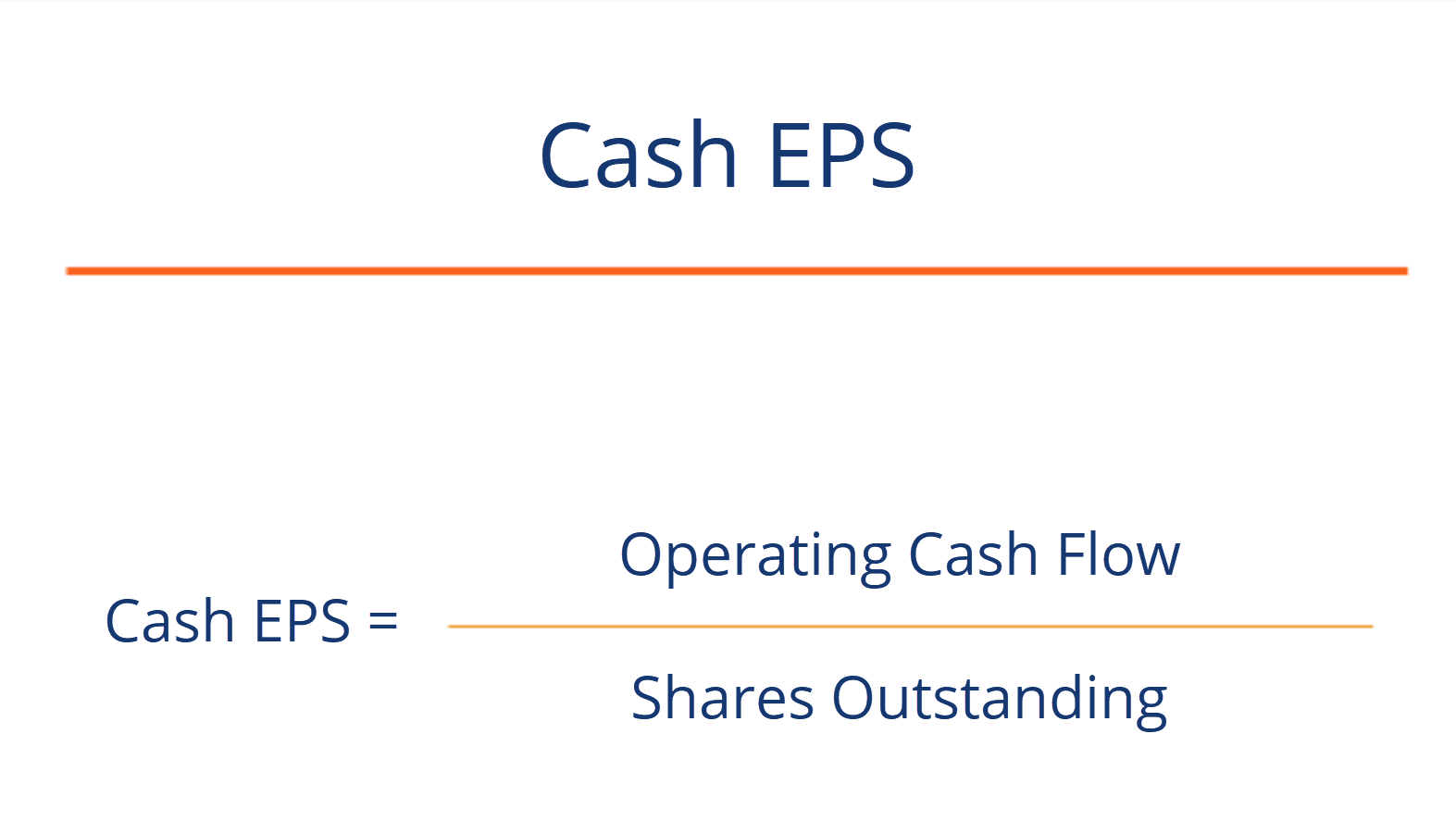

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Definition Formula And Examples

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Operating Cash Flow Formula Examples With Excel Template Calculator

Cash Flow From Operating Activities Direct And Indirect Method Efm

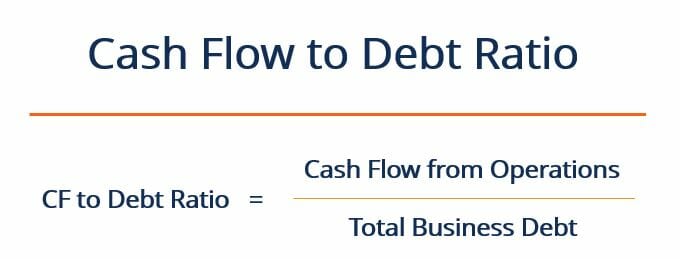

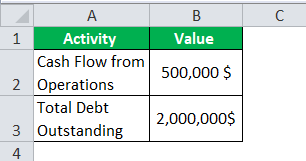

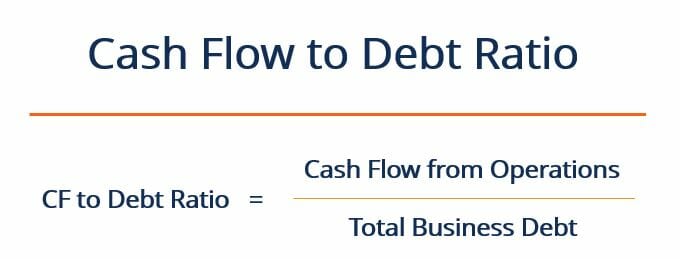

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)